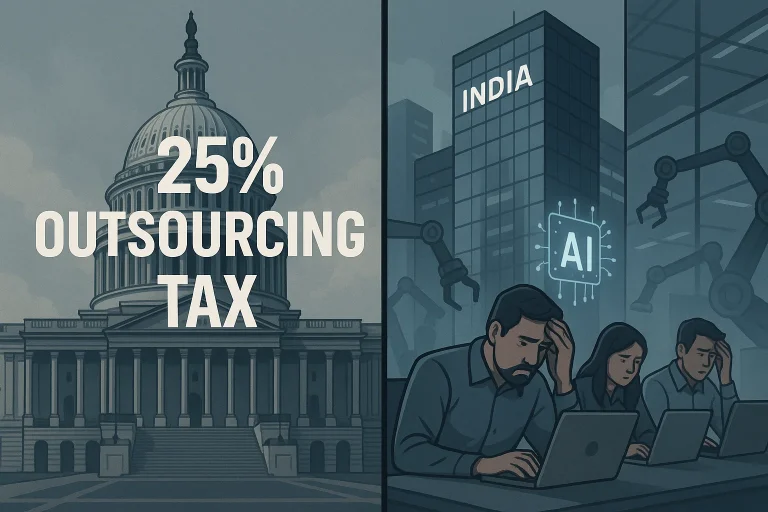

The US HIRE Act is shaking things up for India’s IT industry. Basically, it puts a 25% tax on outsourcing payments, which means American companies might think twice before sending work offshore.

For India, that’s a big deal because a lot of IT firms, freelancers, and startups depend on US clients. Smaller companies could really feel the squeeze since they don’t have the deep pockets to absorb extra costs like the big players do.

On top of that, US firms might change how they run their Global Capability Centers in India, maybe lean more on automation and AI to cut down on expenses.

All of this means fewer traditional outsourcing jobs and a possible shift in tech talent between the two countries.

Indian businesses are now facing a crucial moment: whether they can adapt quickly by exploring new technologies and markets will decide how well they weather this change.

To understand the impact of the US HIRE Act better, Invezz spoke with Rajiv Dabhadkar, founder National Organization for Software and Technology Professionals, who laid out how the new tax rules can lead to a major shift in India’s IT sector.

Excerpts:

Invezz: How do you think the HIRE Act will affect smaller or mid-sized Indian IT companies compared to bigger firms?

Rajiv Dabhadkar: The HIRE Act could disproportionately affect smaller or mid-sized Indian IT companies compared to bigger firms.

These companies might struggle to absorb the 25% tax on outsourcing payments, leading to increased competition and potential client renegotiations.

Smaller companies might find it harder to absorb the additional tax burden, and larger firms may have more resources to adapt to the new tax regime. As a result, smaller companies may face pressure to reduce prices or lose clients.

Invezz: Could the HIRE Act change how US companies invest in or use Global Capability Centers (GCCs) in India?

Rajiv Dabhadkar: The HIRE Act could significantly impact how US companies invest in or use GCCs in India.

With a 25% tax on outsourcing payments, US companies might reconsider their GCC setups in India or restructure their operations to avoid penalties.

This could lead to a shift in GCCs towards more automation and AI-driven services.

US companies might reconfigure their GCCs to minimize tax liabilities, adopt more automation and AI to reduce human labor costs, and explore other markets beyond the US to reduce dependence on a single region.

Invezz: What impact might the new tax and rules have on Indian freelancers and startups working with US clients?

Rajiv Dabhadkar: The HIRE Act’s 25% tax on outsourcing payments could also affect Indian freelancers and startups working with US clients.

This might lead to reduced demand for freelance services or force startups to adapt their business models to absorb the additional costs.

Freelancers and startups may need to adjust their pricing or services to remain competitive, and exploring non-US clients or markets could be a viable strategy.

Invezz: With new technologies like AI changing the industry, how big a threat is the HIRE Act to traditional outsourcing jobs?

Rajiv Dabhadkar: The HIRE Act poses a significant threat to traditional outsourcing jobs, especially with the rise of AI and automation.

As companies seek to reduce costs, they may accelerate automation efforts, potentially replacing human labor.

Traditional outsourcing jobs might be at risk due to increased automation, and companies may focus on high-value services that require human expertise.

Workers may need to develop new skills to remain relevant in an automated industry.

Invezz: What can Indian leaders and companies do to protect the IT sector from these kinds of US laws?

Rajiv Dabhadkar: To protect the IT sector, Indian leaders and companies can take several steps.

They can expand into new markets beyond the US to reduce dependence, focus on emerging technologies like AI, cloud, and cybersecurity, establish US offices to bypass outsourcing tax, and collaborate with global companies to enhance service offerings.

Invezz: How might this law affect the flow of tech jobs and talent between India and the US?

Rajiv Dabhadkar: The HIRE Act could affect the flow of tech jobs and talent between India and the US.

With increased costs and potential job losses, Indian IT professionals might face reduced opportunities in the US market.

Fewer job opportunities might be available for Indian IT professionals in the US, and India might need to focus on retaining its talent domestically.

However, emerging technologies and new markets could create new opportunities for Indian IT professionals.

The post Interview: HIRE Act may push US firms to automate, cutting reliance on India, says NOSTOPS founder Rajiv Dabhadkar appeared first on Invezz