Negotiators from the United States and China have hammered out a preliminary agreement aimed at de-escalating their persistent trade tensions, a development that could potentially revive the flow of sensitive and critical goods between the world’s two largest economies.

Following two days of intensive discussions in London, officials from both nations announced they had agreed on a framework to implement a consensus reached during a previous round of talks in Geneva.

From London to leaders

American and Chinese negotiators emerged from nearly 20 hours of discussions, held in a Georgian-era mansion near Buckingham Palace, with a sense of cautious optimism.

China’s chief trade negotiator, Li Chenggang, confirmed that both sides had agreed on a structured approach to put into action the understandings achieved in Geneva last month.

The US and Chinese delegations will now take this newly forged proposal back to their respective leaders for approval.

While comprehensive details of the pact were not immediately disclosed, US negotiators expressed strong expectations that critical issues surrounding shipments of rare earth minerals and magnets from China would be resolved.

“Once the presidents approve it, we will then seek to implement it,” US Commerce Secretary Howard Lutnick told reporters in London.

US Trade Representative Jamieson Greer added that although no further meetings are currently scheduled, communication channels between the American and Chinese sides remain open and active, allowing for discussions whenever necessary.

The rare earth sticking point and a path to resolution

The London talks were largely convened at the urging of the Trump administration, which sought to solidify a pledge made by the Chinese government during last month’s Geneva discussions to ease restrictions on shipments of rare earths.

These critical minerals are essential components in a vast array of modern technologies, including electric vehicles, lasers, and mobile phones.

The disagreement over these exports had reignited open economic conflict between the US and China, raising concerns that their nascent trade deal, which included a tariff truce, could collapse.

Such a scenario would pose a fresh and significant threat to the global economy.

“We do absolutely expect that the topic of rare earth minerals and magnets with respect to the United States of America will be resolved in this framework implementation,” Lutnick affirmed.

He further indicated a reciprocal easing of US restrictions:

Also, there were a number of measures the United States of America put on when those rare earths were not coming. You should expect those to come off — sort of, as President Trump said, in a balanced way. When they approve the licenses, then you should expect that our export implementation will come down as well.

The Chinese Foreign Ministry and Ministry for Commerce did not immediately respond to requests for comment on the specifics of the agreement.

Greer also highlighted that the issue of fentanyl, which the Trump administration has cited as a rationale for imposing tariffs on China, remains a priority for the US president.

“We would expect to see progress from the Chinese on that issue in a major way,” he stated.

Export controls and the leverage of critical materials

The recent negotiations have underscored the growing significance of export controls in modern trade disputes, where access to rare minerals or advanced microchips can provide a substantial strategic advantage.

China currently controls a significant portion of the world’s supply of raw materials used in high-tech manufacturing.

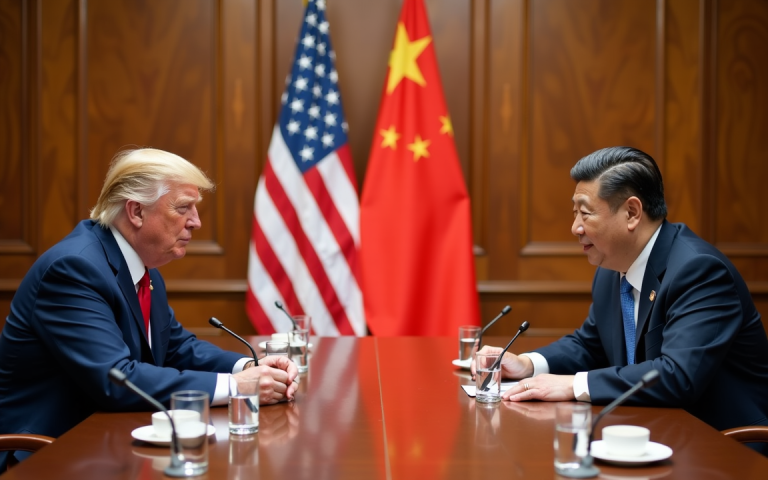

This leverage became particularly apparent over the past several weeks, as complaints from American companies about looming magnet shortages prompted US President Donald Trump to request a direct call with Chinese leader Xi Jinping.

The US had accused Beijing of stalling on sales of these critical materials, although some delays may have been attributable to lengthy lead times within China’s permitting system.

European trade officials and automakers had also voiced concerns about disruptions to supplies from China.

In response, Washington moved last month to limit exports of certain US technologies, including chip design software, jet engine parts, chemicals, and nuclear materials.

In London, the US signaled a willingness to lift these restrictions in exchange for relief on rare earth shipments.

Following the Xi-Trump call last week, Treasury Secretary Scott Bessent, alongside Lutnick and Greer, were dispatched to the UK capital to break the deadlock with a Chinese delegation led by Vice Premier He Lifeng.

The US and China are currently about a third of the way through a 90-day reprieve on the crippling tit-for-tat tariffs they had imposed on each other through April.

The settlement announced in Geneva on May 12 had brought those duties down considerably, though trade between the two economic giants remains significantly disrupted.

China’s exports to the US, for instance, fell by a staggering 34% in May, according to Bloomberg News calculations, the largest drop since February 2020 when the initial wave of the coronavirus pandemic impacted the Chinese economy.

“We hope that the progress we made will be conducive to building trust,” China’s Li Chenggang said, reflecting a desire for a more stable trade relationship.

Market reactions and expert commentary

Financial markets have largely recovered from the bout of volatility that struck when President Trump first introduced his extensive tariff policies in early April, with MSCI’s all-country equity index ending Tuesday at a record high.

Currency markets, however, tell a slightly different story, with the US dollar showing weakness against its major counterparts.

The initial market reaction to the London announcement was minimal, with US equity futures edging slightly lower and the offshore yuan inching higher, while the yen remained little changed.

“Markets will likely welcome the shift from confrontation to coordination,” commented Charu Chanana, chief investment strategist at Saxo Markets, as quoted by Bloomberg.

However, she also tempered expectations: “But the absence of further scheduled meetings signals that we’re not out of the woods yet — it’s now up to Trump and Xi to approve and enforce the deal.”

Josef Gregory Mahoney, a professor of international relations at Shanghai’s East China Normal University, told Bloomberg that the biggest casualty of the trade war has been trust, not just lost sales.

He noted that China is proceeding with caution, aiming to avoid being drawn into what he termed the Trump “circus”.

“We’ve heard a lot about agreements on frameworks for talks. But the fundamental issue remains: chips vs. rare earths,” Mahoney stated.

Everything else is a peacock dance.

The post Rare earths, tariffs & trust: inside the high-stakes US-China deal forged near Buckingham Palace appeared first on Invezz