HSBC expects a “raft of stocks” to benefit from Southeast Asian investments in infrastructure, a slowing Indian economy, and China’s stimulus blitz in 2025.

In particular, the investment firm sees Kia Corp, Meituan, and Krishna Institute of Medical Sciences as high-quality, underappreciated names that are “best positioned to capture growth from these opportunities.”

Let’s take a look at what each of these three has in store for investors.

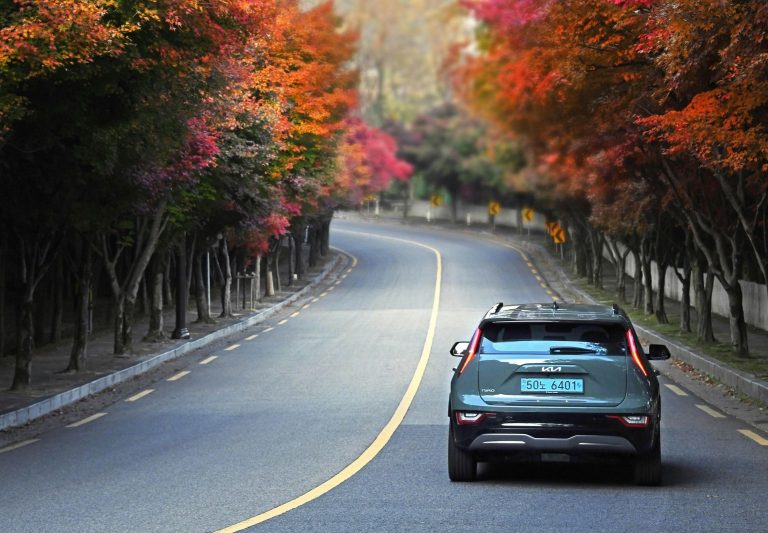

Kia Corp (KRX: 000270)

HSBC dubs Kia stock the “best value play for 2025” as investors are yet to fully appreciate just how competitive this Korean automaker is in EVs and hybrid vehicles space.

Its analyst Will Cho expects Kia to tap on its strong margin profile to launch more competitive and affordable electric vehicles next year. Kia opened its first factory focused on EV production in October.

The investment firm expects any potential weakness in the US due to Trump’s policies to be largely offset by market share gains in the EU region.

Will Cho’s buy recommendation on Kia shares coupled with a price target of 160,000 Korean won translates to a 64% upside from here.

Krishna Institute of Medical Sciences (NSE: KIMS)

HSBC expects Krishna Institute of Medical Sciences to benefit next year as Indians continue to invest in quality health care.

The investment firm sees KIMS as a “best-in-class small-cap” Asian stock that is particularly “well positioned to sustain healthy growth” rates over the long term.

Krishna Institute has moved into high-end procedures including transplants and oncology and is exploring newer markets to unlock new avenues for future growth. It has also committed to expanding its bed capacity by an exciting 60% over the next three years.

Together, these moves will help the company “sustain healthy margins by improving its revenue mix,” as per HSBC.

The investment firm has a 670 INR price target on KIMS that indicates potential for about a 14% upside from here.

Meituan (HKG: 3690)

HSBC recommends investing in Meituan as it’s a “best-in-class large cap” that stands to meaningfully benefit from China’s new policy measures.

The investment firm likes this name as it has remained resilient in the face of macro challenges. “High-quality growth, improving profitability, and limited competition” were among the reasons HSBC cited this week in his bullish note.

Analysts at the firm expect Meituan to grow its top line by 20% this year and another 17% in 2025. “Its earnings quality is one of the best in the sector,” they added.

Compared to its internet peers, Meituan is “relatively under-owned” at writing. Less than half of the global emerging market funds currently own this stock versus “two out of every three funds” for Tencent.

HSBC has a 220 Hong Kong dollar price target on Meituan stock that suggests it could rally up to 30% from here.

The post Top 3 underappreciated Asian stocks to buy in 2025 appeared first on Invezz